How Self-Service Analytics for the Insurance Sector Could Enable Faster Data-Driven Decision Making

Self service analytics can empower insurance companies to take their business decisions from good to great. Read on to find out how.

Customer data is at the center of everything today, but insurance companies still have room for improvement when it comes to using and working with the data at their disposal. According to Accenture, companies only analyze 12% of the data they have.

Yes, only 12%.

That’s a very small number. Everyone, right from insurance agents to marketing managers and even product managers could use data for a variety of things – to stay relevant, to be more targeted in their campaigns, to identify areas for expansion and more. When used correctly, data can yield a lot of returns. For instance, being data driven gives Baloise the ability to provide a much better and highly customized experience for their prospects and customers. And it doesn’t hurt that with Veezoo, Baloise Switzerland has an increased cross and up-selling rate.

So why then, is there still such a high barrier to entry when it comes to people extracting data to make informed and accurate decisions in their day to day jobs?

Why Is Getting Insights from Data on a Day-to-Day Basis Still So Hard?

The problem is not with the data itself, it’s often related to a variety of things surrounding it – such as obtaining the data or being comfortable with coding or the additional skills required to analyze it. Let’s take a quick look at some of the reasons behind this:

-Lack of Technical Skills : Extracting meaningful insights from data often involves the use of SQL or some level of coding knowledge. Usually this is not easy for business users and can be quite daunting at first. And without regular usage or training, it can simply be overlooked. As a result, business users don’t end up using data to find answers to their questions.

A very simple scenario where this is applicable could be a cross-selling or an up-selling opportunity. As an insurance agent, you might have a portfolio of customers that you look after, as well as a set target that you need to achieve by the end of the quarter. In order to make sure that your efforts don’t go to waste and you don’t inadvertently drive prospects away, it makes sense to formulate highly tailored marketing campaigns. A lot of times however, generating several pivot tables and multiple feedback loops, to get to this may not be a feasible option. As a result of this, you’re more likely to shoot off a mass email to all of your customers which may or may not resonate with them, lowering not only your email metrics but also your conversion rate. Additionally, when the time comes for upselling or cross-selling again, your conversion rates suffer a second time. And it becomes a loop.

– Dependencies on Other Teams: Often, in order to counteract the first reason, organizations have dedicated teams that work on cleaning, analyzing and reporting data for different teams. This could often lead to unnecessarily long waiting times for the required data, which means people could abandon this altogether and “go with their gut”.

How about a situation where your supervisor insists that a certain sales technique is “the best”. But you aren’t able to get the desired results using that technique. While this may mean something is wrong, it could simply indicate that you need to analyze the data to see which technique works for you and adopt that. However, more often than not, this data is kept away from you and you have to depend on your central data team to get these numbers, so you desperately try to follow the path that’s been “tried and tested”. Except, this approach may not be producing the desired results and you’re not sure what to change because of a lack of access to information.

-Tools That Are Not User Friendly: Traditional tools used to extract insights are not always user friendly. Their interfaces can be quite hard to navigate or make sense of unless you’re very familiar with them – and that takes time.

Imagine a situation where you’re looking for a quick win from your pool of leads. There is the old fashioned way where you pick up the phone and call all of them – and mayhem ensues because you’re probably disrupting atleast half of your prospects’ days. But after a long and painful day of being on the phone, you manage to make it work.

Alternatively, you could identify high potential leads with the help of your marketing team and of course your experience. Then, you prioritize calling these leads first and your task is completed in just a few hours.

Option 2 is much more appealing, but you might choose to go with Option 1, because the tool your team has been equipped with is both complex and hard to use and you don’t have the bandwidth or the patience to deal with it

Making data accessible to those who work with it regularly has significant payoffs like coming up with a new model for insurance for Swiss Re, but it is still out of reach for many organizations today.

Data Democratization Is Not Just A Dream

All of the reasons and scenarios above describe a very high barrier to entry to access relevant information that allows insurance personnel to do their daily job well. And in turn bring in the best business results for their organization.

So it is ironic that 80% of analysts’ time is spent on simply discovering and preparing data for business users like insurance agents. The very same information that agents are having a hard time accessing and leveraging to its full potential.

Probably because people are yet to discover a tool that is easy to use, fast and preferably requires no training.

But it is wholly possible to have a scenario where your sales and marketing engines are running smoothly, with a little (or a lot of) help from data.

What if insurance agents could find a list of potential customers to cross-sell or up-sell to on their own, without bothering your extremely busy data experts multiple times? Or what if your sales team regulated their own performance by adopting successful approaches from their peers?

In simple terms, the goals that we set for ourselves are more ambitious than those imposed on us. As a result of this, employees are more engaged and motivated to reach their personal goals. Why not make it easier for them to engage with these goals by providing them with the tools for this?

It definitely saves the trouble associated with repeated back and forth, potential bottlenecks and lost opportunities. Most importantly, empowering employees to hit the targets they impose on themselves means a better bottom line for your business.

The benefits of using a user-friendly business intelligence tool are many, so let’s take a closer look at how an organization where data democratization is “business as usual” could work.

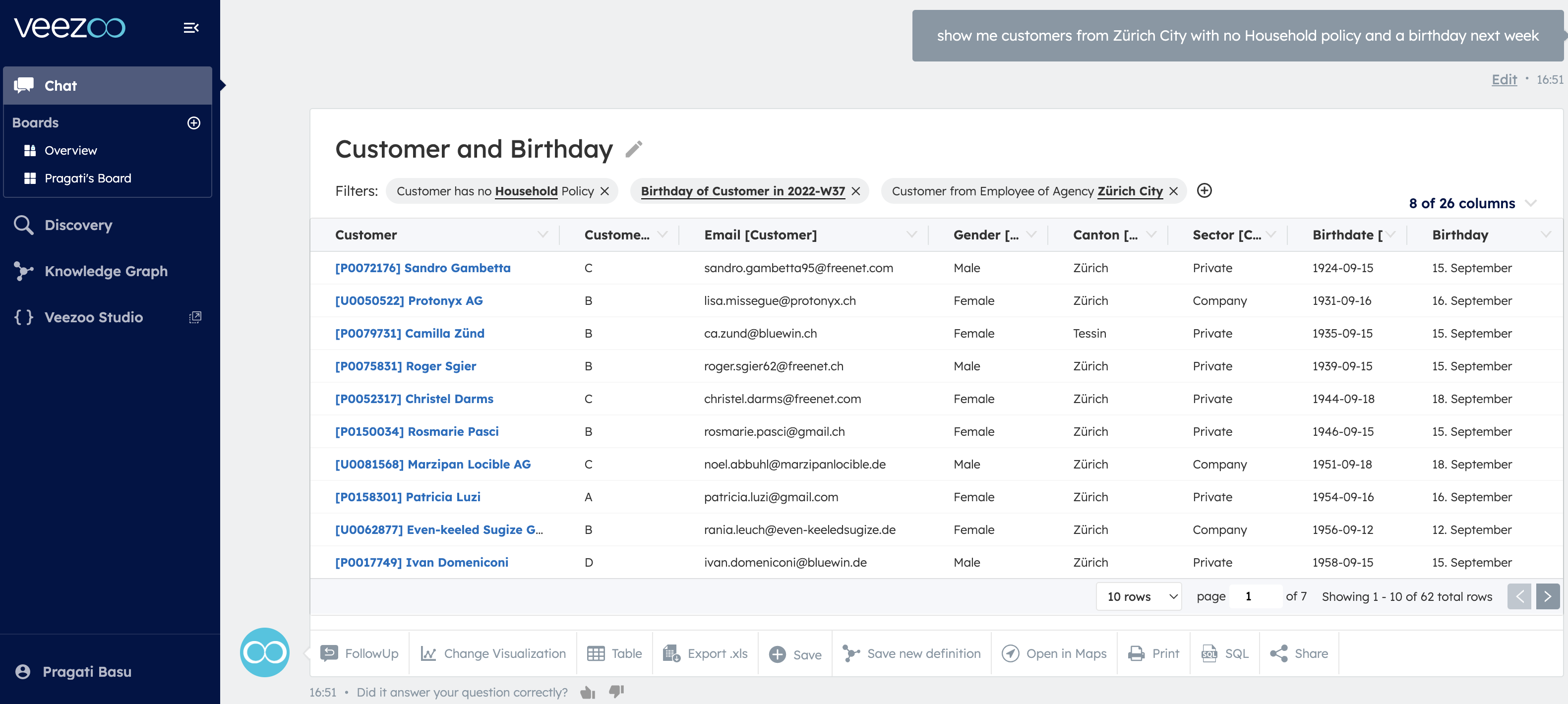

- Your marketing team, through various channels, brings in qualified leads for your sales team. But what if they could bring in leads that are “ready-to-buy”. This eliminates unnecessary back and forth communication between both sales and marketing regarding lead quality. Which is a big win. Let’s say that your marketing team wants to run a promotion for home insurance for all customers in Zurich whose birthday is next week.

You just have to ask:

Veezoo’s easy Q and A interface

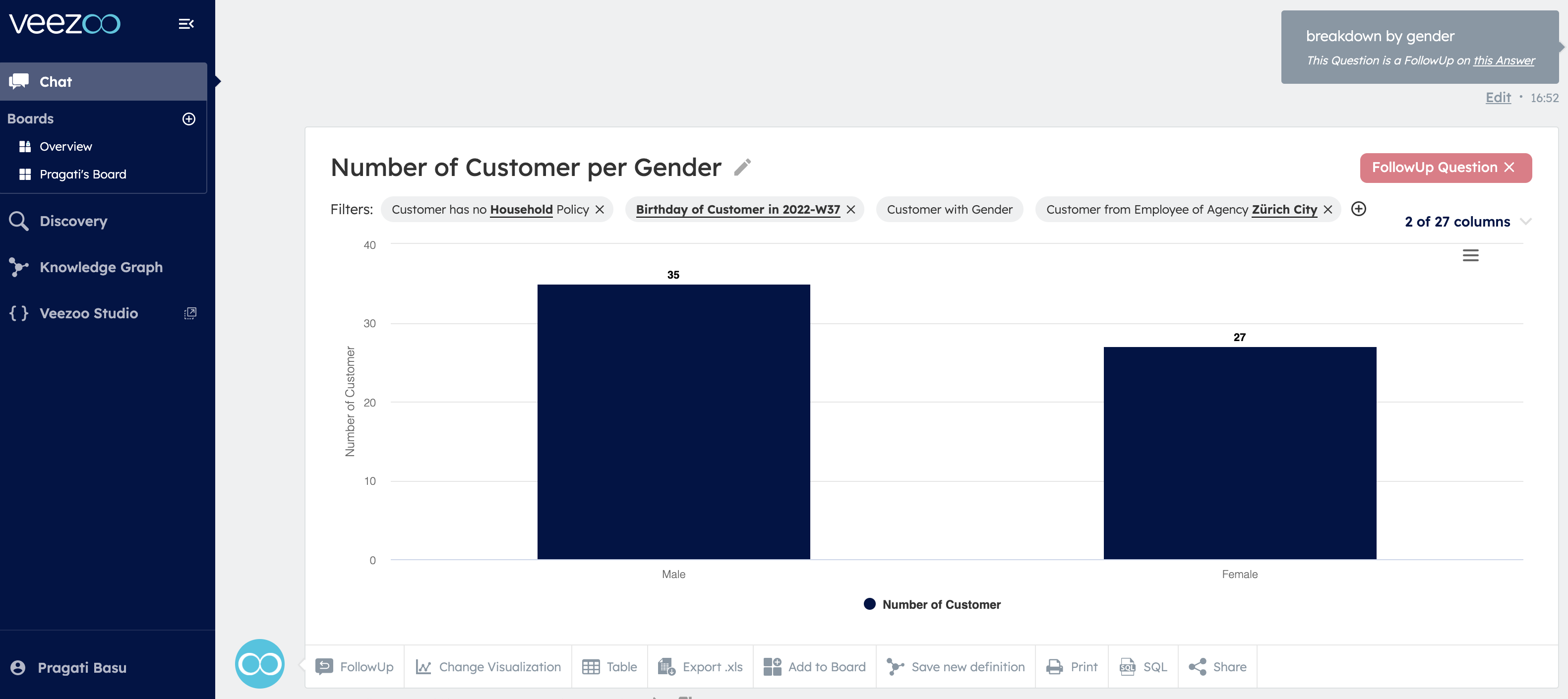

Then, maybe you want to target females only, all you have to do is choose the “breakdown by gender.” option and you’ll get your split.

Follow up questions like Gender Split are made easy with Veezoo

In fact, your team can run highly targeted campaigns based on a variety of parameters that the sales team requires/appreciates and send over this information with the leads. This leads to a much higher conversion rate.

- Next, out of the various leads, your Sales team knows which leads to prioritize, based on intel from the marketing team. With the additional sales data that they have access to, they’re then able to employ the best sales tactics for various leads and close deals. But you can take this one step further as a sales manager, trying to understand the performance of your team.

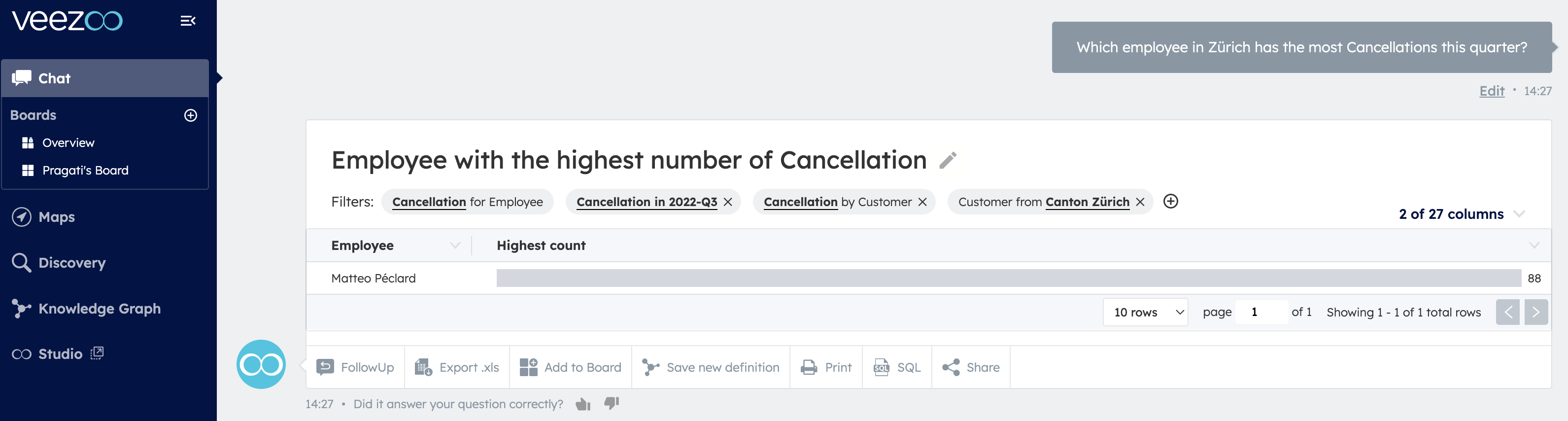

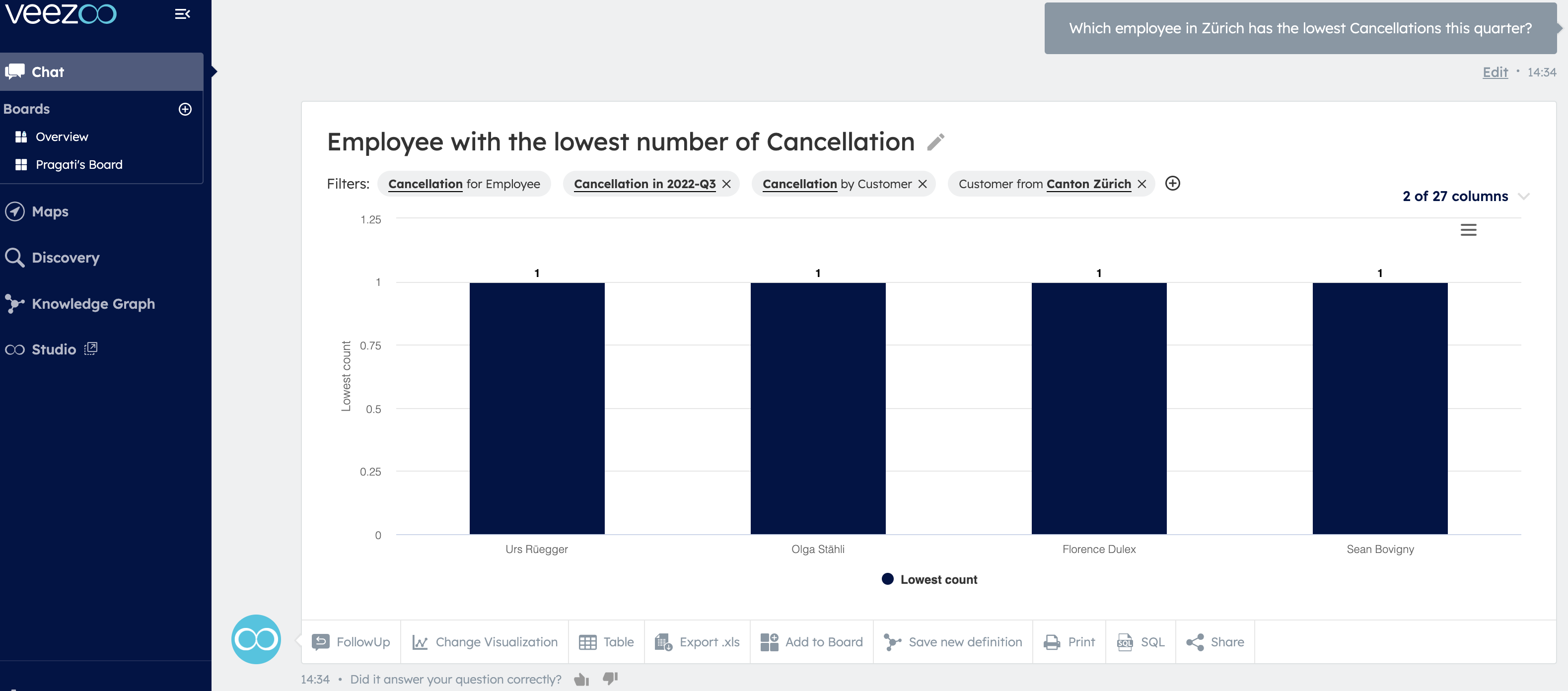

Let’s say you want to know who has the highest number of cancellations this quarter.

Sales Numbers with Veezoo

Turns out it’s Matteo.

Next, as a manager, you could try and connect Matteo with the person who has the least number of cancellations this quarter. And again, you can receive the answer for this in seconds by just asking.

How to Optimize Sales with Veezoo

Matteo can be connected to any of these four to see what they’re doing and adapt his technique accordingly.

This may seem like a small thing but these tactics can help agents learn from one another, be highly customized in their approach to prospects, find opportunities to upsell more easily and also employ the tactics that are best suited to the company strategy.

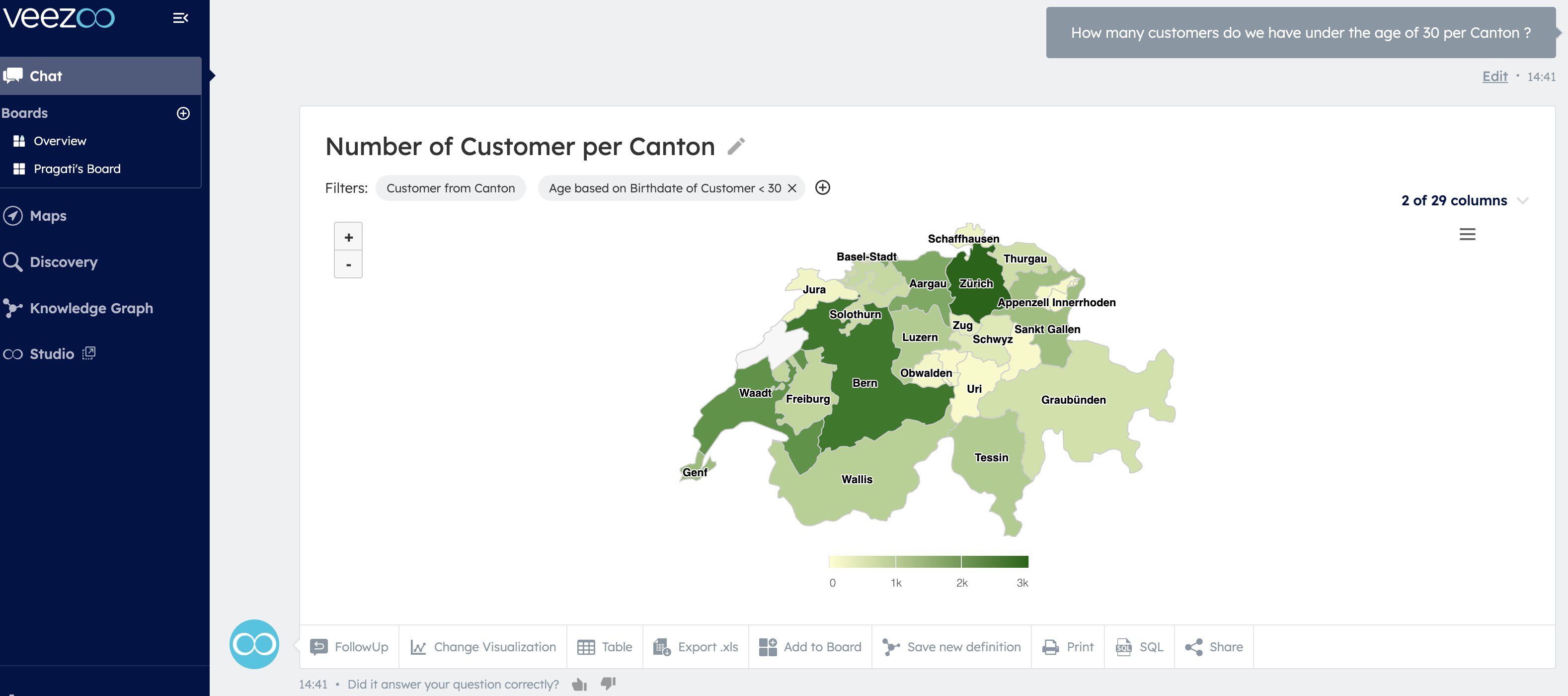

- This can also be applied to after-sales services, wherein a customer success manager may want to see what all the customers in his portfolio may have in common. For instance, something as simple as how many customers they have under the age of 30.

Again, all you have to do is ask:

Customer specific data per canton from Veezoo

As per the image, Zurich has the highest number of customers under the age of 30.

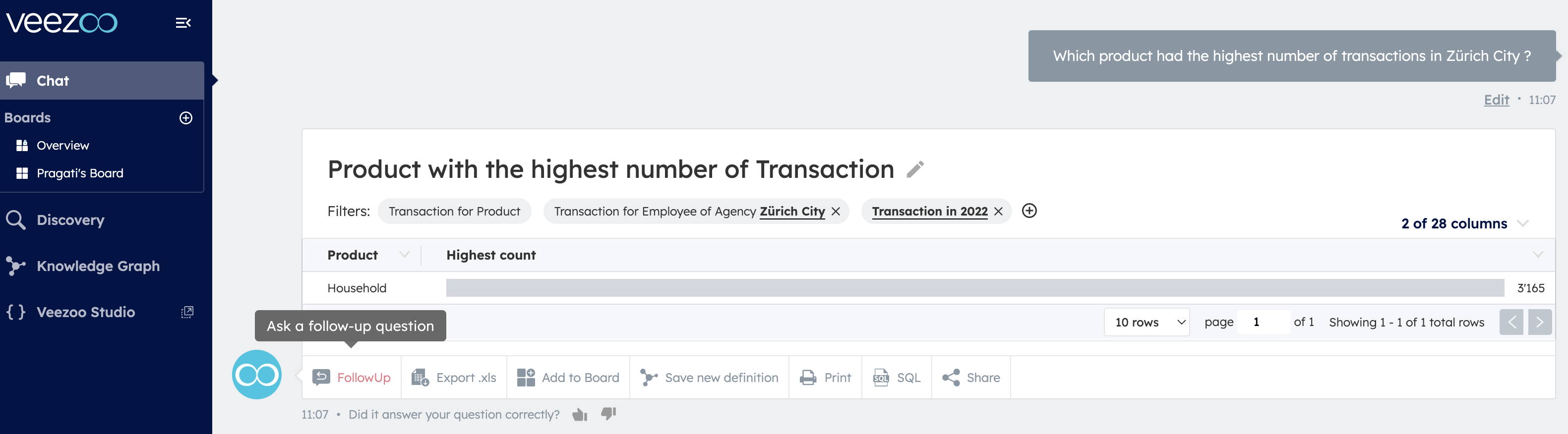

- Additionally, during strategy meetings, stakeholders would have access to data to validate their hypotheses with regard to next steps – in a matter of minutes, rather than the whole messy process of asking data teams to give them relevant insights, have a meeting and then ask for more information …and repeating this loop “n” number of times.

Top selling product in Zurich, along with the option for follow-ups

In the picture above, we can see that the Household insurance category is the best seller in Zurich.

We can combine this with a report on how many clients changed addresses in Zurich last quarter and send them a highly targeted offer for a new house insurance policy.

Rather than sending a mass email to your database offering a discount on a policy which may not be relevant to most of them.

That’s what a tool like Veezoo could empower your team to do.